Many lenders insist on setting up a mortgage escrow account to ensure the borrower’s keeping up with the tax and insurance costs. The property tax is another important thing to consider when selecting your future house. Median property taxes in New York counties origination fee, closing costs, insurance payments etc).įor more precise assessment, the interest rate used for these calculations is based on the current mortgage rates in New York, given a $400,000 home price and a 10% down payment. Although the interest rate makes up the bulk of the APR value, the latter also includes various fees (e.g. It is worth mentioning that you are actually charged an annual percentage rate (commonly abbreviated as APR), which is not exactly the same as the interest rate.

Fixed-rate conforming loans are allowed to last 30 years most, while adjustable-rate options typically have shorter terms.Īn interest rate is a fixed or floating fraction of the principal that you must pay through the duration of the loan.

#FREE MORTGAGE CALCULATOR NY FULL#

80% of the home price given a 20% down payment).Ī loan term is the period of full repayment of your mortgage by making scheduled payments. The remaining amount makes up the principal (e.g. To avoid costly insurance, you must come up with at least 20% down (in case of a conventional loan). A down payment is the portion of this price to be paid upfront.

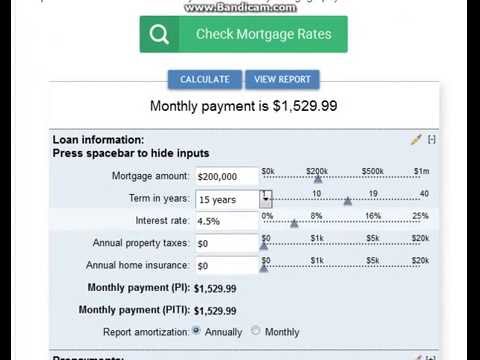

The first piece of the puzzle is the home price – that is, how much you are planning to spend on your future property. Let’s take a closer look at each field in order to gain a better understanding of the mortgage in New York parameters. Use our house payment calculator New York for thorough planning of your future spendings.

#FREE MORTGAGE CALCULATOR NY HOW TO#

Why and How to Use Our Mortgage Calculator A detailed step-by-step instruction follows below. Use our fast and simple mortgage calculator NY to evaluate your future monthly expenses. How to calculate mortgage payment in New York Several lesser known but trustworthy options include New York-based GuardHill Financial Corp, Amerifund Home Mortgage LLC. These include such recognizable names as Rocket Mortgage, Morty Inc, First Citizens Bank. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment.The most popular mortgage lenders in New York operate nationwide. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money.įor most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. These autofill elements make the home loan calculator easy to use and can be updated at any point. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet.

0 kommentar(er)

0 kommentar(er)